2026 Economic Outlook: High-Growth Investment Sectors

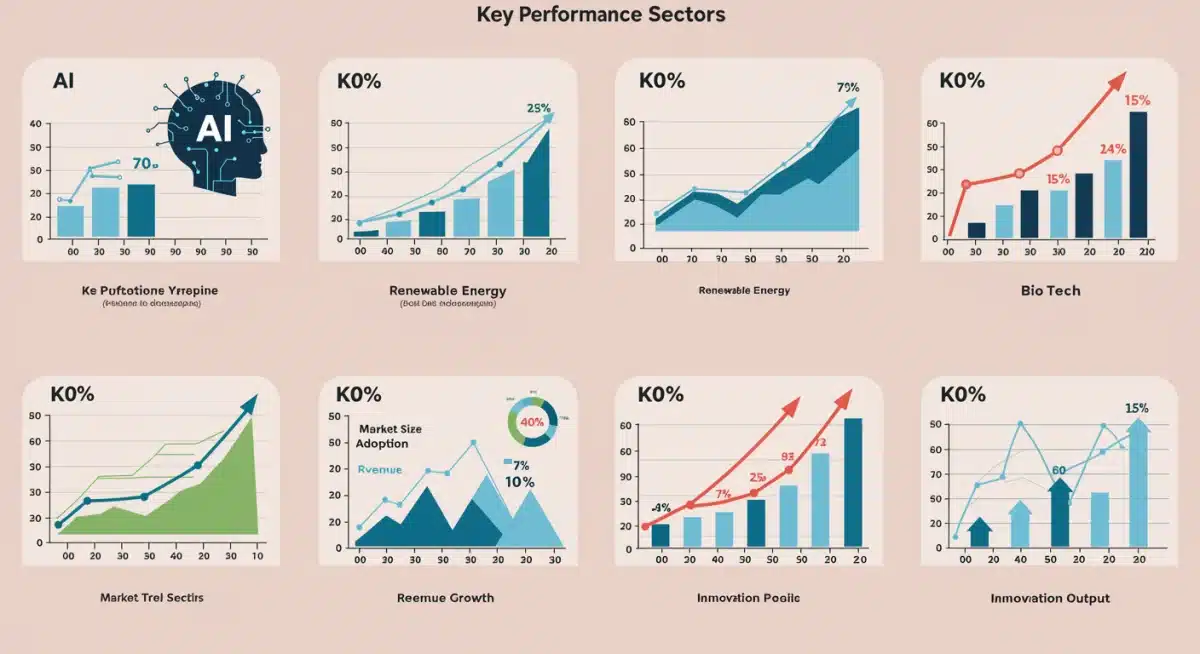

The 2026 economic outlook points toward significant growth potential in specific investment sectors, offering discerning investors opportunities for achieving a 10% return.

As we navigate towards 2026, understanding the 2026 economic outlook: identifying high-growth investment sectors for a 10% return becomes paramount for savvy investors. The global landscape is constantly evolving, presenting both challenges and unprecedented opportunities. This article delves into the key economic drivers and specific industries poised for substantial expansion, guiding you towards informed investment decisions.

Understanding the 2026 Global Economic Landscape

The year 2026 is anticipated to be shaped by a complex interplay of technological advancements, geopolitical shifts, and evolving consumer behaviors. Understanding these macro trends is crucial for forecasting market direction and identifying sectors with robust growth potential. Economic resilience will likely be tested by ongoing supply chain optimizations and inflationary pressures, yet innovation continues to be a powerful catalyst.

Digital transformation remains at the forefront, accelerating across all industries. Governments and corporations are increasingly prioritizing sustainability, driving significant investment into green technologies. Furthermore, demographic changes, particularly an aging global population, are reshaping demands in healthcare and related services. These foundational elements lay the groundwork for a dynamic investment environment.

Key Economic Drivers

Several factors are expected to drive economic activity and influence investment returns. Technological innovation, particularly in artificial intelligence and automation, will continue to revolutionize various sectors. Global trade dynamics, influenced by regional agreements and geopolitical stability, will also play a crucial role in market performance.

- Technological Innovation: AI, quantum computing, and biotechnology advancements.

- Sustainability Initiatives: Increased focus on renewable energy and circular economy models.

- Geopolitical Stability: Impact of international relations on supply chains and market confidence.

- Consumer Behavior Shifts: Growing demand for personalized experiences and ethical products.

The convergence of these drivers suggests a landscape rich with opportunities for those who can accurately predict and adapt to the emerging economic paradigm. Investors should look beyond traditional metrics and consider the long-term implications of these transformative forces.

Artificial Intelligence and Automation: The Next Frontier

Artificial Intelligence (AI) and automation are not merely buzzwords; they represent a fundamental shift in how businesses operate and how value is created. By 2026, these technologies are expected to be deeply integrated into various industries, from manufacturing and logistics to customer service and healthcare, driving efficiency and opening new revenue streams. The potential for a 10% return in this sector is considerable, fueled by continuous innovation and widespread adoption.

Investment in AI infrastructure, including data centers, specialized hardware, and advanced algorithms, will be critical. Companies that successfully leverage AI to optimize processes, personalize customer experiences, or develop entirely new products will be at the forefront of this growth. This sector is characterized by rapid development and a high barrier to entry, favoring established players and innovative startups alike.

Growth in AI Applications

The expansion of AI applications is vast and diverse. From predictive analytics that inform business strategies to autonomous systems that enhance operational safety, AI’s utility is constantly expanding. Investors should focus on companies demonstrating a clear competitive advantage in specific AI niches.

- Generative AI: Revolutionizing content creation, design, and software development.

- Edge AI: Bringing AI processing closer to data sources for faster, more secure applications.

- Robotics and Automation: Enhancing productivity in manufacturing, logistics, and service industries.

- AI-powered Cybersecurity: Developing advanced solutions to combat sophisticated cyber threats.

The pervasive nature of AI ensures its continued relevance and growth. Companies that integrate AI effectively across their operations are likely to outperform their peers, making this a prime area for high-growth investment. Monitoring patent filings and strategic partnerships can offer insights into future market leaders.

Renewable Energy and Green Technologies: A Sustainable Bet

The global push towards sustainability and decarbonization makes renewable energy and green technologies an undeniably critical investment sector for 2026. With increasing government incentives, declining technology costs, and growing public awareness, the transition to a green economy is accelerating. This sector offers not just financial returns but also significant environmental and social impact.

Investments in solar, wind, geothermal, and hydropower are expanding, alongside emerging areas like green hydrogen and advanced battery storage. The entire value chain, from raw material extraction to energy distribution, presents opportunities. Companies innovating in energy efficiency, waste reduction, and sustainable agriculture are also part of this promising landscape.

Emerging Green Tech Opportunities

Beyond traditional renewable sources, a new wave of green technologies is gaining traction. These innovations address critical environmental challenges and offer scalable solutions for a sustainable future. Identifying these early-stage opportunities can lead to substantial long-term gains.

- Green Hydrogen Production: A clean fuel source with vast potential for industrial and transportation sectors.

- Carbon Capture, Utilization, and Storage (CCUS): Technologies to mitigate industrial emissions.

- Sustainable Agriculture: Innovations in vertical farming, precision agriculture, and alternative proteins.

- Circular Economy Solutions: Businesses focused on recycling, reuse, and waste valorization.

The long-term trajectory for renewable energy and green technologies is overwhelmingly positive. As policies strengthen and consumer preferences shift, this sector is well-positioned for sustained high growth, making it a cornerstone of any forward-looking investment portfolio aiming for a 10% return by 2026.

Personalized Healthcare and Biotechnology Advancements

The healthcare sector, particularly areas focusing on personalization and biotechnology, is set for transformative growth by 2026. Advances in genomics, AI-driven diagnostics, and novel therapeutic approaches are revolutionizing patient care and creating immense investment opportunities. The demand for more effective, tailored medical solutions is escalating, driven by an aging population and increasing prevalence of chronic diseases.

Precision medicine, which tailors treatments to an individual’s genetic makeup, lifestyle, and environment, is becoming a reality. Biotechnology companies developing gene therapies, mRNA vaccines, and advanced diagnostic tools are at the forefront. Additionally, digital health platforms, telemedicine, and wearable health tech are expanding access to care and empowering individuals to manage their health proactively.

Innovations in Medical Science

The pace of innovation in medical science is astounding, constantly pushing the boundaries of what’s possible. These breakthroughs offer not only life-changing treatments but also significant financial upside for investors. Focusing on companies with strong R&D pipelines and regulatory approvals is key.

- Gene Editing Technologies: CRISPR and other tools for correcting genetic defects.

- mRNA Therapeutics: Beyond vaccines, exploring applications for cancer and autoimmune diseases.

- Advanced Diagnostics: AI-powered imaging, liquid biopsies, and early disease detection.

- Digital Therapeutics: Software-based interventions for managing chronic conditions.

The confluence of scientific discovery, technological integration, and societal need positions personalized healthcare and biotechnology as a prime sector for achieving significant investment returns. The ethical considerations and regulatory landscape will continue to evolve, but the fundamental growth drivers remain strong.

Digital Infrastructure and Connectivity

In an increasingly interconnected world, digital infrastructure and connectivity form the backbone of modern economies. By 2026, the demand for faster, more reliable, and ubiquitous internet access will only intensify, driven by the proliferation of IoT devices, cloud computing, and advanced AI applications. This sector underpins nearly every other high-growth area, making it a foundational investment.

Investments in 5G and 6G networks, fiber optics, satellite internet, and data centers are crucial. Companies providing cybersecurity solutions, cloud services, and edge computing infrastructure are also vital components. As remote work, online education, and digital entertainment become more entrenched, the need for robust digital infrastructure will continue to expand exponentially.

Future of Connectivity

The future of connectivity extends beyond merely faster internet. It involves creating a seamlessly integrated digital ecosystem that supports the next generation of technological innovation. Investors should consider the long-term trends shaping how we connect and interact digitally.

- Metaverse Infrastructure: Building the foundational layers for immersive digital experiences.

- Quantum Networking: Developing secure communication channels resistant to traditional hacking methods.

- IoT Connectivity Solutions: Enabling billions of connected devices to communicate efficiently.

- Satellite Internet Expansion: Providing global internet access, especially to underserved areas.

The digital infrastructure sector offers a compelling case for high-growth investment due to its essential role in global commerce and innovation. As the world becomes more digitized, the companies that build and maintain these critical networks will see sustained demand and profitability, making a 10% return a realistic target.

Fintech Innovation and Digital Finance

Fintech, or financial technology, continues to disrupt traditional banking and financial services, presenting significant investment opportunities for 2026. The shift towards digital payments, blockchain-based finance, and AI-driven wealth management is reshaping how individuals and businesses manage their money. This sector is characterized by rapid innovation and a strong potential for high returns as new technologies gain mainstream adoption.

Key areas of growth include challenger banks offering superior digital experiences, blockchain applications beyond cryptocurrencies (e.g., smart contracts, decentralized finance), and platforms leveraging AI for personalized financial advice and fraud detection. The regulatory landscape is evolving to accommodate these innovations, creating a more stable environment for growth.

Disruptive Financial Technologies

The disruptive potential of fintech lies in its ability to make financial services more accessible, efficient, and cost-effective. Investors looking for a 10% return should focus on companies that are successfully challenging established norms and creating new value propositions.

- Decentralized Finance (DeFi): Blockchain-based financial applications operating without intermediaries.

- Embedded Finance: Integrating financial services directly into non-financial platforms and apps.

- Robo-Advisors: AI-powered platforms providing automated, algorithm-driven financial planning services.

- Cross-Border Payments: Innovations that reduce costs and increase speed of international transactions.

Fintech is not just about technology; it’s about reimagining the entire financial ecosystem. Companies that can combine technological prowess with a deep understanding of consumer needs and regulatory requirements are poised for significant success, making digital finance a high-yield investment area.

Strategic Approaches for a 10% Return in 2026

Achieving a 10% return in 2026 requires more than just identifying high-growth sectors; it demands a strategic and disciplined investment approach. Diversification, continuous market monitoring, and a long-term perspective are crucial for navigating the dynamic economic landscape. Investors should consider a balanced portfolio that includes both established leaders and promising emerging players within the identified sectors.

Risk management is equally important. While high-growth sectors offer significant upside, they can also come with increased volatility. Therefore, understanding individual risk tolerance and allocating capital accordingly is paramount. Leveraging professional financial advice can also provide valuable insights and help in constructing a resilient investment strategy tailored to personal financial goals.

Portfolio Diversification Strategies

Diversification is a cornerstone of prudent investment, especially when targeting ambitious returns. Spreading investments across different high-growth sectors and even within those sectors can mitigate risks and enhance overall portfolio stability.

- Sectoral Diversification: Allocate funds across AI, renewable energy, healthcare, digital infrastructure, and fintech.

- Geographic Diversification: Consider global opportunities beyond the U.S. market.

- Asset Class Diversification: Include a mix of equities, bonds, and alternative investments where appropriate.

- Company Stage Diversification: Balance investments in large-cap leaders with smaller, innovative startups.

By adopting a well-thought-out strategy, investors can position themselves to capitalize on the growth opportunities presented by the 2026 economic outlook. Regular review and adjustment of the portfolio based on market performance and economic indicators will be key to sustaining momentum towards the targeted 10% return.

| Key Investment Sector | Growth Drivers & Potential |

|---|---|

| Artificial Intelligence | Integration across industries, efficiency gains, new product development. |

| Renewable Energy | Decarbonization efforts, government incentives, falling technology costs. |

| Personalized Healthcare | Genomics, AI diagnostics, aging population, digital health adoption. |

| Digital Infrastructure | Demand for 5G/6G, cloud computing, IoT, and cybersecurity services. |

Frequently Asked Questions About 2026 Investments

The primary economic drivers for 2026 include continued technological innovation, especially in AI, a global push towards sustainability and green technologies, evolving geopolitical landscapes, and significant shifts in consumer behavior towards digital and personalized services.

Technology sectors expected to yield high returns include artificial intelligence and automation, with a focus on generative AI and edge AI. Additionally, digital infrastructure supporting 5G/6G, cloud computing, and IoT devices will be crucial for sustained growth.

Yes, renewable energy and green technologies remain strong investment areas for 2026. This is driven by increasing global decarbonization efforts, supportive government policies, and continuous advancements in solar, wind, and green hydrogen technologies, offering robust growth potential.

Achieving a 10% investment return by 2026 involves strategic diversification across high-growth sectors like AI, renewable energy, personalized healthcare, and fintech. It also requires careful risk management, continuous market monitoring, and potentially seeking professional financial guidance.

Personalized healthcare is a significant growth area for 2026, driven by breakthroughs in genomics, AI-driven diagnostics, and biotechnology. The increasing demand for tailored medical solutions, coupled with an aging population, positions this sector for substantial investment returns.

Conclusion

The 2026 economic outlook presents a compelling array of opportunities for investors seeking substantial returns. By strategically focusing on high-growth sectors such as Artificial Intelligence, Renewable Energy, Personalized Healthcare, Digital Infrastructure, and Fintech, individuals can position their portfolios for a target of 10% growth. Success hinges on a thoughtful approach to diversification, continuous adaptation to market dynamics, and a clear understanding of the underlying drivers of innovation and demand. As the world continues its rapid transformation, informed and agile investment decisions will be the key to unlocking significant financial prosperity.